OUR 2018 ANNUAL MEETING OF STOCKHOLDERS WILL BE HELD AT OUR NEW CORPORATE

MASCO CORPORATION

Notice of Annual Meeting of Stockholders

| | | | | Date: | | May 9, 2016 | | | Time: | | 10:00 A.M. Eastern time | | | Place: | | Masco Corporation | | | 21001 Van Born Road | | | Taylor, Michigan 48180OFFICES, WHICH ARE LOCATED AT 17450 COLLEGE PARKWAY, LIVONIA, MI 48152

|

THIS PROXY STATEMENT AND THE ENCLOSED PROXY CARD ARE BEING MAILED OR OTHERWISE MADE AVAILABLE TO STOCKHOLDERS ON OR ABOUT MARCH 29, 2018.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS | MASCO 2018 | | | | |  | | MASCO CORPORATION Notice of Annual Meeting of Stockholders | | |

Stockholders of record at the close of business on March 16, 2018 are entitled to vote at the Annual Meeting or any adjournment or postponement of the meeting. Whether or not you plan to attend the Annual Meeting, you can ensure that your shares are represented at the meeting by promptly voting by internet or by telephone, or by completing, signing, dating and returning your proxy card in the enclosed postage prepaid envelope. Instructions for each of these methods and the control number that you will need are provided on the proxy card. You may withdraw your proxy before it is exercised by following the directions in the proxy statement. Alternatively, you may vote in person at the meeting. By Order of the Board of Directors,

Kenneth G. Cole Vice President, General Counsel and Secretary | | | | | | | Date: Place: Time: Website: | | May 11, 2018 Masco Corporation Corporate Office, 17450 College Parkway, Livonia,

Michigan 48152 9:30 a.m. – 10:00 a.m. www.masco.com |

| | | | | | | | | | The purposes of the Annual Meeting are: 1. To elect three Class III directors; 2. To consider and act upon a proposal to approve the compensation paid to our named executive officers; 3. To ratify the selection of PricewaterhouseCoopers LLP as our independent auditors for 2018; and 4. To transact such other business as may properly come before the meeting. | 1. | To elect three Class I Directors; |

| 2. | To consider and act upon a proposal to approve the compensation paid to our named executive officers; |

| 3. | To ratify the selection of PricewaterhouseCoopers LLP as our independent auditors for 2016; and |

| 4. | To transact such other business as may properly come before the meeting. |

The Company recommends that you vote as follows: • FOR each Class I DirectorIII director nominee; • FOR the approval of the compensation paid to our named executive officers; and • FOR the selection of PricewaterhouseCoopersPriceWaterhouseCoopers LLP as our independent auditors for 2016.2018. |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON MAY 11, 2018: THIS PROXY STATEMENT AND THE MASCO CORPORATION 2017 ANNUAL REPORT TO STOCKHOLDERS, WHICH INCLUDES THE COMPANY’S ANNUAL REPORT ON FORM10-K, ARE AVAILABLE AT: http://www.ezodproxy.com/masco/2018 THE COMPANY WILL PROVIDE A COPY OF ITS ANNUAL REPORT ON FORM10-K, WITHOUT CHARGE, UPON A STOCKHOLDER’S WRITTEN REQUEST TO: INVESTOR RELATIONS, MASCO CORPORATION, 17450 COLLEGE PARKWAY, LIVONIA, MICHIGAN 48152.

MASCO 2018 | 2018 PROXY STATEMENT SUMMARY | | | | | | |  | | Stockholders

2018 Proxy Statement Summary | | |

This summary highlights information to assist you in reviewing the proposals you will be voting on at our 2018 Annual Meeting. This summary does not contain all of the information you should consider; you should read the entire proxy statement carefully before voting. The proposals for our Annual Meeting are the election of our Class III Directors, the approval of the compensation paid to our named executive officers (who we generally refer to as our “executive officers” in this proxy statement), and the ratification of the selection of PricewaterhouseCoopers LLP as our independent auditors for 2018. CORPORATE GOVERNANCE AND OUR BOARD OF DIRECTORS Our Board of Directors is committed to maintaining our high standards of ethical business conduct and corporate governance principles and practices. Our corporate governance practices include: | ✔ | | Robust Stockholder Engagement - We reach out to our largest stockholders each spring and fall to discuss a broad range of record at the close of business on March 11, 2016 are entitled to vote at the Annual Meeting or any adjournment or postponement of the meeting. Whether or not you plan to attend the Annual Meeting, you can ensure that your shares are represented at the meeting by promptly voting by internet or by telephone, or by completing, signing, datingexecutive compensation and returning your proxy cardgovernance topics. | |

| ✔ | | Board Refreshment - Seven new independent directors have joined our Board since 2012, and in the enclosed postage prepaid envelope. Instructions for each of these methods and the control number that you will need are provided on the proxy card. You may withdraw your proxy before it is exercised by following the directions in the proxy statement. Alternatively, you may vote in person at the meeting.By Order2015 our Board appointed a new Chairman of the Board and new Chairs of Directors,

Kenneth G. Cole

Vice President, General Counsel and Secretary

March 24, 2016

| our Board Committees. | | | IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

STOCKHOLDER MEETING TO BE HELD ON MAY 9, 2016: THIS PROXY STATEMENT AND THE

MASCO CORPORATION 2015 ANNUAL REPORT TO STOCKHOLDERS ARE AVAILABLE AT:

http://www.ezodproxy.com/masco/2016

|

| | | MASCO 2016 | ✔ | | Organization and Talent Review - Our Organization and Compensation Committee performs an annual review of our talent strategy and CEO and senior management succession planning. | | PROXY STATEMENT SUMMARY |

2016 Proxy Statement Summary

| ✔ | | Political Contribution Oversight - Our Corporate Governance and Nominating Committee oversees our political contributions in accordance with our Political Contribution Policy. | |

This summary highlights information

| ✔ | | Separation of our CEO and Chairman of the Board - The positions of our CEO and Chairman of the Board are currently separated; our Chairman of the Board is an independent director. | |

| ✔ | | Board Self-Evaluation - Annually, our directors review the effectiveness of our Board through a self-evaluation process. | |

| ✔ | | Majority Voting for our Directors - In uncontested elections, our director nominees must receive more than 50% of the votes cast to assist you in reviewing the proposals you will be voting on atelected to our 2016 Annual Meeting. This summary does not containBoard. | |

| ✔ | | Director Independence - Ten of our twelve directors are independent, and all of the information you should consider; you should read the entire proxy statement carefully before voting. The proposals for our Annual Meeting are the electionmembers of our Class I Directors, the approval of the compensation paid to our named executive officers,Audit, Organization and the ratification of the selection of PricewaterhouseCoopers LLP as our independent auditors.CORPORATE GOVERNANCE AND OUR BOARD OF DIRECTORS

Our Board of Directors is committed to maintaining our high standards of ethical business conductCompensation, and corporate governance principlesCorporate Governance and practices. Our corporate governance practices include:

Nominating Committees are independent.| | ü | Robust Stockholder Engagement – We reach out to our largest stockholders each spring and fall to discuss a broad range of executive compensation and governance topics. |

| ü | Board Refreshment – Five new independent directors have joined our Board since 2012, and in 2015 our Board appointed a new Chairman of the Board and new Chairs of our Board Committees. |

2018 PROXY STATEMENT SUMMARY | MASCO 2018 | ü | Separation of our CEO and Chairman of the Board – The positions of our CEO and Chairman of the Board are separated; our Chairman of the Board is an independent director. |

DIRECTOR NOMINEES | ü | Board Self-Evaluation – Annually, our directors review the effectiveness of our Board through a self-evaluation process. |

| ü | Majority Voting for our Directors – In uncontested elections, our director nominees must receive more than 50% of the votes cast to be elected to our Board. |

| ü | Director Independence – Nine of our eleven directors are independent, and all of the members of our Audit, Organization and Compensation, and Corporate Governance and Nominating Committees are independent. |

DIRECTOR NOMINEES

The Class I

The Class III Director Nominees for our Board of Directors are: | | | | | | | | | | | | | | |  | | Donald R. Parfet

| | | |  | | Lisa A. Payne

| | | |  | | Reginald M. Turner | | |

| | | | Mark R. Alexander | | DIRECTOR SINCE: 2014 | | POSITION:Senior Vice President of Campbell

Soup Company and President of Americas

Simple Meals and Beverages, Campbell Soup

Company (through April 2, 2018) | | INDEPENDENT: Yes | | COMMITTEES: Audit Committee; Corporate

Governance and Nominating Committee | | Director Since:

2012

| | | | Director Since:

2006

| | | | Director Since:

2015

| | Position:

Managing Director,

Apjohn, LLC and

General Partner, Apjohn Ventures Fund, Limited Partnership

| | | | Position:

Vice President,

Taubman Centers, Inc.

(through March 2016)

| | | | Position:

Attorney and Member Clark Hill PLC

| | | Independent:

Yes

| | | | | Independent:

Yes

| | | | | Independent:

Yes

| | | Committees:

Organization and Compensation (Chair)

Audit

| | | | | Committees:

Audit (Chair)

Organization and Compensation

| | | | | Committees:

Audit

Corporate Governance and Nominating

|

| | |

| | | | Richard A. Manoogian | | DIRECTOR SINCE:1964 |

| If elected, each would serve for a three-year term concluding at our 2019 Annual Meeting.

POSITION: Our Chairman Emeritus

| | | PROXY STATEMENT SUMMARY | | MASCO 2016

|

| INDEPENDENT:No | | COMMITTEES: None | |

|

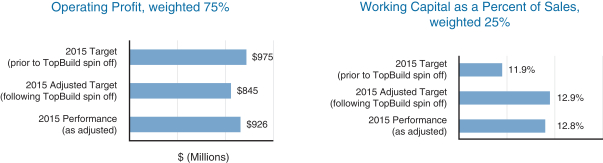

| | | 2015 FINANCIAL PERFORMANCE

We delivered strong financial results in 2015. Our reported sales for the full year increased 2% to $7.1 billion, and increased 6% excluding the impact of foreign currency translation. We delivered operating margin expansion and strong cash flow generation, and we returned our cabinet business to profitability. Additionally, we successfully spun off 100% of our installation and other services businesses into an independent, publicly-traded company, TopBuild Corp., through a tax-free distribution to our stockholders on June 30, 2015. This transformed Masco into a home improvement and building products company where our distinct advantages – brand and innovation – are key success factors.

In addition to delivering sales and profit growth, we returned capital to our stockholders by repurchasing over 17 million shares of stock and increasing our dividends by six percent in 2015. Finally, we continued the execution of our strategy to position us for future growth by focusing on leveraging opportunities across our businesses, driving the full potential of our core businesses and actively managing our portfolio.

EXECUTIVE COMPENSATION

Based on our strong financial performance in 2015, we exceeded the target goals for our annual and long-term performance-based compensation programs.

| | | | 2015 Annual Performance ProgramJohn C. Plant

| | Under our annual performance program we grant restricted stock and pay cash bonuses to our executive officers if we meet our performance goals for operating profit and working capital as a percent of sales. The following tables reflect our 2015 target goals, our performance relative to our target goals and the compensation we paid to our named executive officers under our 2015 annual performance program:DIRECTOR SINCE: 2012

| | | | | | | | | | | | 2015 Annual Performance Program | | | | Performance Metric | | Target | | Performance

(as adjusted) | | Weighted Performance

Percentage | | | Operating Profit (in millions) | | $845 | | $926 | | 144% | | | Working Capital as a Percent of Sales | | 12.9% | | 12.8% | |

| | | | | | | | | | | | | | | | Executive Officer | | Cash Bonus

($) | | | Restricted

Stock Award ($) | | | Total 2015 Annual

Performance Compensation ($) | | | | Keith J. Allman | | | 2,376,000 | | | | 2,376,001 | | | 4,752,001 | | | | John G. Sznewajs | | | 695,500 | | | | 695,403 | | | 1,390,903 | | | | Richard A. O’Reagan | | | 500,500 | | | | 500,506 | | | 1,001,006 | | | | Amit Bhargava | | | 252,000 | | | | 252,039 | | | 504,039 | | | Christopher K. Kastner | | | 252,000 | | | | 252,039 | | | 504,039 |

| | | MASCO 2016 | | PROXY STATEMENT SUMMARY |

2016 Proxy Statement Summary

2013-2015 Long Term Performance Program

Under our Long Term Cash Incentive Program (“LTCIP”), our executive officers earn a cash award if we meet a return on invested capital performance goal for a three-year period. The following tables reflect our target goal for the 2013-2015 LTCIP performance period, our performance relative to our target goal and the compensation we paid to our named executive officers who participated in the 2013-2015 LTCIP:

| | | | | | | | | | | | 2013-2015 LTCIP | | | | Performance Metric | | Target | | Performance (as adjusted) | | Performance

Percentage(1) | | | Return on Invested Capital | | 8.50% | | 10.49% | | 214% | (1) Although we achieved a performance percentage of 214%, our payout percentage under the LTCIP is capped at 200%. |

| | | | | | | Executive Officer | | Cash Award ($)(1) | | | Keith J. Allman | | 675,000 | | | John G. Sznewajs | | 795,000 | | | Richard A. O’Reagan | | — | | | Amit Bhargava | | — | | | Christopher K. Kastner | | — | (1) Messrs. O’Reagan, Bhargava and Kastner were not executive officers in 2013 and therefore did not participate in our 2013-2015 LTCIP.

|

Stockholder Outreach

In 2015, we continued our robust stockholder engagement program through which we encourage certain of our stockholders to engage in dialogue with us twice per year. During the year, we reached out to stockholders holding almost 55% of our outstanding shares. We received positive feedback from the stockholders with whom we spoke regarding the structure of our compensation programs and practices, which was reflectivePOSITION: Retired Chairman of the strong support we have received for our say-on-pay proposal over the past four years. We provide reports on the feedback we receive to our OrganizationBoard and Compensation Committee and Corporate Governance and Nominating Committee.

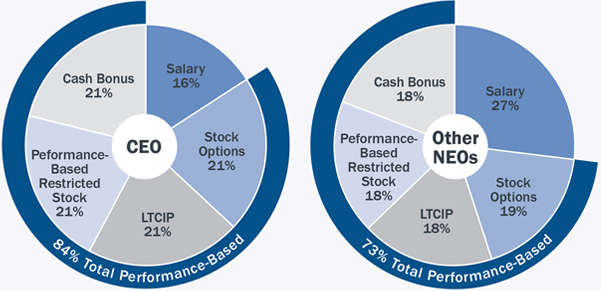

Our Compensation Practices

During 2015, our Organization and Compensation Committee (the “Compensation Committee”) continued to review our compensation programs and practices to ensure our interests and the objectives for our compensation programs are aligned. At our 2015 Annual Meeting, over 98%

Chief Executive Officer of the votes cast on our say-on-pay proposal approved the compensation we paid to our executive officers. Although the say-on-pay vote is advisory and non-binding, our Compensation Committee believes this approval percentage indicates strong support for our continued efforts to enhance our pay-for-performance practices, and our Compensation Committee concluded that our stockholders endorse our current executive compensation programs and practices.

| | | PROXY STATEMENT SUMMARY | | MASCO 2016 |

TRW Automotive

Holdings Corp. | | Our compensation practices include:INDEPENDENT:Yes

| ü | Long-Term Incentives –Our compensation programs are weighted toward long-term incentives. We give approximately equal weight to performance-based restricted stock, stock options and our three-year LTCIP. |

| | COMMITTEES:Audit Committee; Corporate

Governance and Nominating Committee | ü | Five-Year Vesting – Our performance-based restricted stock and stock option awards vest over five years, which is longer than typical market practice. |

| ü | Long-Term Performance Program – A significant portion of our executive officers’ compensation opportunity is based on the achievement of a long-term performance goal. |

If elected, each would serve for a three-year term concluding at our 2021 Annual Meeting. BOARD REFRESHMENT We have had significant Board refreshment over the past several years. Seven new independent directors have joined our Board since 2012, two of whom joined since last year, which, combined with our directors who have experience with us, provides a desirable balance of deep, historical understanding of our Company and new and diverse perspectives. STOCKHOLDER OUTREACH In determining our executive compensation and corporate governance practices, our Board believes it is important to consider feedback from our stockholders. During 2017, we continued our robust stockholder engagement program through which we encourage certain of our stockholders to engage in dialogue with us twice per year. During the year, we reached out to stockholders holding approximately 45% of our outstanding shares, and discussed with certain of these stockholders an overview of our business strategies, board composition and refreshment, corporate sustainability practices and our annual and long-term performance compensation programs. We received positive feedback from the stockholders with whom we spoke regarding the structure of our compensation programs and practices, which was reflective of the strong support we have received for oursay-on-pay proposal over the past five years. We provide reports on the feedback we receive to our Organization and Compensation Committee (“Compensation Committee”) and Corporate Governance and Nominating Committee (“Governance Committee”). | ü | Clawback Policy – If we restate our financial statements, other than as a result of changes to accounting rules or regulations, our clawback policy allows us to recover incentive compensation paid to our executives in the three-year period prior to the restatement, regardless of whether misconduct caused the restatement. |

| ü | Stock Ownership Requirements – We have minimum stock ownership requirements for our executive officers, including requiring our CEO to own stock valued at six times his base salary. |

| ü | Double-Trigger—We have double-trigger vesting of equity on a change in control. |

| ü | Tally Sheets and Risk Analysis – Our Compensation Committee uses tally sheets and analyzes risk in setting executive compensation. |

| ü | Competitive Analysis – On an annual basis, our Compensation Committee reviews a market analysis of executive compensation paid by our peer companies and published survey data for comparably-sized companies. |

| ü | Limited Perquisites – We provide limited perquisites to our executive officers. |

Our compensation practices donot include:

MASCO 2018 | 2018 PROXY STATEMENT SUMMARY | û | Excise Tax Gross-Up – We have eliminated the excise tax gross-up feature on all of the equity grants made since 2012. |

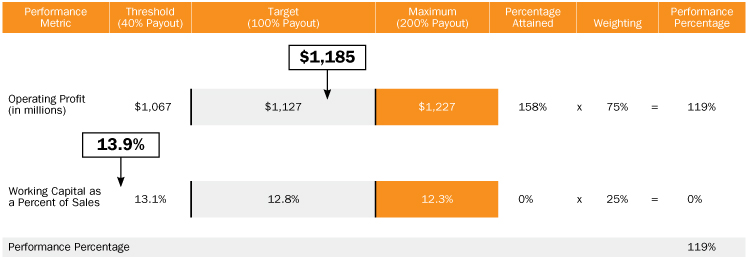

2017 FINANCIAL PERFORMANCE We delivered solid financial results in 2017. Our reported sales for the full year increased 4% to $7.6 billion, our operating profit for the full year increased 11% to $1.2 billion and we increased our operating profit margin to 15.3% from 14.3%. Our sales growth was driven by our longstanding commitment to customer-focused innovation and successful new programs. Our operating profit growth demonstrates our strong operating leverage and continued improvements in cost productivity. In addition to delivering sales and profit growth, in 2017 we returned capital to our stockholders by repurchasing $331 million in shares of our stock and increasing our annual dividend by approximately 5%. Finally, we continued the execution of our strategy to position us for future growth by focusing on leveraging opportunities across our businesses, driving the full potential of our core businesses and actively managing our portfolio. 2017 EXECUTIVE COMPENSATION Based on our strong financial performance in 2017, we exceeded the target goals for our annual and long-term performance-based compensation programs. 2017 Annual Performance Program Under our annual performance program, we pay cash bonuses and grant restricted stock to our executive officers if we meet our performance goals for operating profit and working capital as a percent of sales. The following tables reflect our 2017 target goals, our performance relative to our target goals and the compensation we paid to our executive officers under our 2017 annual performance program: | û | Hedging or Pledging – Our policy prohibits executives and directors from hedging our stock and from making future pledges of our stock. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Performance Metric | | Target | | | | Performance

(as adjusted) | | | | Weighted

Performance

Percentage | | | | | | | | | | Operating Profit (in millions) | | $1,127 | | | | $1,185 | | | | 119% | | | Working Capital as a Percent of Sales | | 12.8% | | | | 13.9% | | | | | |

| û | Contractual Termination Arrangements –We have no change in control agreements, contractual severance agreements or employment agreements providing for severance payments with our executive officers. |

See “Our 2017 Annual Performance Program” in our Compensation Discussion and Analysis for a description of our calculation of operating profit and working capital as a percent of sales performance. | û | Option Repricing – Our equity plan prohibits the repricing of options without stockholder approval. |

Table of Contents | | | | | | | | | | | | | | | | | | | | Name | | Cash

Bonus ($) | | | | Restricted

Stock

Award ($) | | | | Total 2017

Annual

Performance

Compensation

($) | | | | | | | | | | Keith J. Allman | | 2,144,100 | | | | 2,143,996 | | | | 4,288,096 | | | | | | | | | | John G. Sznewajs | | 609,800 | | | | 609,621 | | | | 1,219,421 | | | | | | | | | | Richard A. O’Reagan | | 468,600 | | | | 468,486 | | | | 937,086 | | | | | | | | | | Kenneth G. Cole | | 344,200 | | | | 344,202 | | | | 688,402 | | | | | | | | | | Christopher K. Kastner | | 265,100 | | | | 264,998 | | | | 530,098 | | |

2015-2017 Long-Term Performance Program Under our Long Term Cash Incentive Program (“LTCIP”), our executive officers earn a cash award if we meet a return on invested capital performance goal for a three-year period. The following tables reflect our target goal for the 2015-2017 LTCIP performance period, our performance relative to our target goal and the compensation we paid to our executive officers: | | | | | | | | | | | | | | | | | | | | Performance Metric | | Target | | | | Performance

(as adjusted) | | | | Performance

Percentage | | | | | | | | | | Return on Invested Capital | | 12.0% | | | | 13.6% | | | | 132% | | |

See “Our Long Term Incentive Program” in our Compensation Discussion and Analysis for a description of our calculation of ROIC performance.

2018 PROXY STATEMENT SUMMARY | MASCO 2018

Name | LTCIP for 2015-2017 ($) | | | | | | | | Keith J. Allman | | 2,178,000 | | | | | | John G. Sznewajs | | 618,800 | | | | | | Richard A. O’Reagan | | 445,500 | | | | | | Kenneth G. Cole | | 313,200 | | | | | | Christopher K. Kastner | | 231,000 | | | What companies are in our peer group?

|

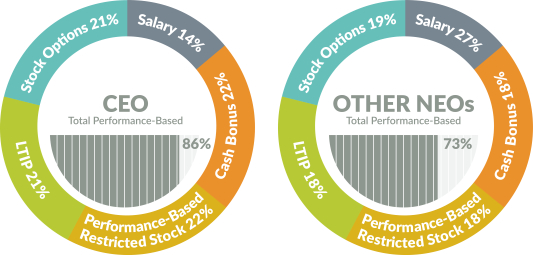

OUR COMPENSATION PRACTICES During 2017, our Compensation Committee reviewed our compensation programs and practices to ensure our interests and the objectives for our compensation programs are aligned. At our 2017 Annual Meeting, 98% of the votes cast on oursay-on-pay proposal approved the compensation we paid to our executive officers. Although thesay-on-pay vote is advisory andnon-binding, our Compensation Committee believes this approval percentage indicates strong support for our continued efforts to enhance ourpay-for-performance practices, and our Compensation Committee concluded that our stockholders endorse our current executive compensation programs and practices. Our compensation practices include: ✔ Long-Term Incentives - Our compensation programs are weighted toward long-term incentives. We give approximately equal weight to performance-based restricted stock, stock options and our three-year LTCIP. In 2017, we modified our long-term incentive program by replacing the cash award with performance-based restricted stock units (“PRSUs”). ✔ Five-Year Vestingfor Equity Awards - Our performance-based restricted stock and stock option awards vest over five years, which is longer than typical market practice. ✔ Long-Term Performance Program - A significant portion of our executive officers’ compensation opportunity is based on the achievement of a long-term performance goal. ✔ Clawback Policy - If we restate our financial statements, other than as a result of changes to accounting rules or regulations, our clawback policy allows us to recover incentive compensation paid to our executives in the three-year period prior to the restatement, regardless of whether misconduct caused the restatement. ✔ Stock Ownership Requirements - We have minimum stock ownership requirements for our executive officers, including requiring our CEO to own stock valued at six times his base salary. As of December 31, 2017, each of our executive officers met his or her stock ownership requirement. ✔ Double-TriggerVesting - We have double-trigger vesting of equity on a change in control. ✔ Tally Sheets and Risk Analysis - Our Compensation Committee uses tally sheets and analyzes risk in setting executive compensation. ✔ Competitive Analysis - On an annual basis, our Compensation Committee reviews a market analysis of executive compensation paid by our peer companies and published survey data forcomparably-sized companies. ✔ Limited Perquisites - We provide limited perquisites to our executive officers.

MASCO 2018 | 2018 PROXY STATEMENT SUMMARY Our compensation practices donot include: | | | 28 | | Can our Compensation Committee use its discretion when awarding compensation?

| | | 29 | | Has our Compensation Committee engaged a compensation consultant?

| | | 29 | | Tax Treatment | | | 29 | | Conclusion | | | 29 | | Compensation Committee Report | | | 30 | | Proposal 2: Advisory Vote to Approve the Compensation of Our Named Executive Officers | | | 31 | | PART III – COMPENSATION OF EXECUTIVE OFFICERS | | Summary Compensation Table | | | 32 | | Grants of Plan-Based Awards | | | 34 | | Outstanding Equity Awards at Fiscal Year-End | | | 35 | | Option Exercises and Stock Vested | | | 36 | | Retirement Plans | | | 36 | | Payments Upon Change in Control | | | 38 | | Payments Upon Retirement, Termination, Disability or Death | | | 39 | | PART IV – AUDIT MATTERS | | Audit Committee Report | | | 42 | | PricewaterhouseCoopers LLP Fees | | | 43 | | Principal Accountant Fees and Services

| | | 43 | | Audit Committee Pre-Approval Policies and Procedures

| | | 43 | | Proposal 3: Ratification of Selection of Independent Auditors | | | 44 | | PART V – EXECUTIVE OFFICERS AND BENEFICIAL OWNERSHIP | | Executive Officers | | | 45 | | Security Ownership of Management and Certain Beneficial Owners | | | 46 | | Section 16(a) Beneficial Ownership Reporting Compliance | | | 47 | | PART VI – GENERAL INFORMATION | | 2016 Annual Meeting of Stockholders – Questions and Answers | | | 48 | | Who is entitled to vote at the Annual Meeting?

| | | 48 | | What is the difference between holding shares as a record holder and as a beneficial owner?

| | | 48 | | What is a broker non-vote?

| | | 48 | | How are abstentions and broker non-votes treated?

| | | 48 | | What constitutes a quorum?

| | | 48 | | How can I submit my vote?

| | | 49 | | How many votes are needed for each proposal to pass?

| | | 49 | | Is my proxy revocable?

| | | 49 | | Who is paying for the expenses involved in preparing and mailing this proxy statement?

| | | 49 | | What happens if additional matters are presented at the Annual Meeting?

| | | 50 | | What is “householding” and how does it affect me?

| | | 50 | | Our Website

| | | 50 | | 2017 Annual Meeting of Stockholders | | | 51 | | Proxy Statement Proposal

| | | 51 | | Matter for Annual Meeting Agenda

| | | 51 | | Director Candidate Nomination

| | | 51 | | Other Matters | | | 52 | ✘ | | Excise TaxGross-Ups - We have eliminated the excise taxgross-up feature on all of the equity grants made since 2012. |

| | | PART I – CORPORATE GOVERNANCE | | MASCO 2016 |

Corporate Governance

This section

| ✘ | | Hedging or Pledging - Our policy prohibits executives and directors from hedging our stock and from making future pledges of our proxy statement provides information on the qualifications and experience of our director nominees and incumbent directors, the structure of our Board and our Board committees, and other important corporate governance matters.DIRECTOR AND DIRECTOR NOMINEES

Our Board of Directors is divided into three classes. Following the election of the Class I directors nominated at this Annual Meeting, the terms of office of our Class I, Class II and Class III directors will expire at the Annual Meeting of Stockholders in 2019, 2017 and 2018, respectively, or when their respective successors are elected and qualified.

In addition to meeting the criteria that are described below under “Board of Directors – Board Composition and Membership,” each of our director nominees and each continuing director brings a strong and unique background and set of skills to our Board. As a result, our Board as a whole possesses competence and experience in a wide variety of areas, including executive management, finance and accounting, executive compensation, risk management, manufacturing, global operations, corporate governance and board oversight, marketing and brand management, portfolio strategy, business development, governmental relations, law and compliance and real estate development. Biographical information for each of our director nominees and each continuing director is set forth below, including the specific business experience, qualifications, attributes and skills that led our Board to conclude that each should serve as a director.

| | | MASCO 2016 | | PART I – CORPORATE GOVERNANCEstock. |

| ✘ | | Contractual Termination Arrangements - We have no change in control agreements, contractual severance agreements or employment agreements providing for severance payments with our executive officers. |

| ✘ | | Option Repricing - Our equity plan prohibits the repricing of options without stockholder approval. |

MASCO 2018 | TABLE OF CONTENTS Table of Contents | | | | | | | DIRECTOR NOMINEES FOR CLASS I

(Term PART I - CORPORATE GOVERNANCE

| | | | | | | Director and Director Nominees | | | 1 | | | | Director Nominees for Class III (Term Expiring at Annual Meeting in 2021) | | | 2 | | | | Class I Directors (Term Expiring at the Annual Meeting in 2019) | | | | | | | | | | |  | | Donald R. Parfet

| | | | | | Age: 63 | Director since 2012

RELEVANT SKILLS AND EXPERIENCE

As an executive with responsibilities for numerous global businesses, Mr. Parfet brings extensive financial and operating experience to our Board, including financial and corporate staff management responsibilities and senior operational responsibilities for multiple global business units. His experience in business development and venture capital firms provides our Board with a valued perspective on growth and strategy. He is also experienced in leading strategic planning, risk assessment, human resource planning and financial planning and control. His global operating experience, strong financial background and proven leadership capabilities are especially important to our Board’s consideration of product and geographic expansion and business development opportunities.

BUSINESS EXPERIENCE

| | | | | | • Director of Kelly Services, Inc., Rockwell Automation, Inc. and Pronai Theraputics, Inc.

• Director and trustee of a number of charitable and civic organizations

| | • Senior Vice President, Pharmacia Corporation, a pharmaceutical company, from which he retired in 2000

• Served as a senior corporate officer of Pharmacia & Upjohn and The Upjohn Company, predecessors of Pharmacia Corporation

| | |

| | | | | | | | | | |  | | Lisa A. Payne

| | | | | | Age: 57 | Director since 2006

RELEVANT SKILLS AND EXPERIENCE

Ms. Payne possesses extensive financial, accounting and corporate finance expertise gained through her experience as Chief Financial Officer of Taubman Centers and as an investment banker. Her financial focus and proficiency helped guide Taubman Centers through the economic recession and increased shareholder value. She brings to our Board an understanding of growth strategy. In addition, Ms. Payne’s extensive experience in real estate investment, development and acquisition gives her an informed and thorough understanding of macroeconomic factors that may impact our business.

BUSINESS EXPERIENCE

| | | | | | • Director of J.C. Penney Company, Inc., Rockwell Automation, Inc. and Taubman Centers, Inc. (through March 2016)

• Taubman Centers, Inc.:

• Chief Financial Officer (2005-2015)

• Executive Vice President and Chief Financial and Administrative Officer(1997-2005)

| | • Investment banker, Goldman, Sachs & Co. (1987-1997)

| | |

| | | PART I – CORPORATE GOVERNANCE | | MASCO 2016 |

| | | | | | | | 4 | | | |  | | Reginald M. Turner

| | | | | | Age: 56 | Director since 2015

RELEVANT SKILLS AND EXPERIENCE

As an accomplished litigator and legal advisor with expertise in labor and employment law and government relations, Mr. Turner brings to our Board powerful insight in these areas. His background, coupled with his service as a director of a financial institution and a member of its enterprise risk committee, make him a valuable asset to our Board in the areas of risk management and finance. Mr. Turner has numerous and varied experiences in business, civic and charitable leadership roles, and his skills and insight benefit our Board as it considers issues of risk management, corporate governance and legal risk.

BUSINESS EXPERIENCE

| | | | | | | | | | | | • Director of Comerica Incorporated since 2005, where he currently chairs that board’s Enterprise Risk Committee and serves on its Audit Committee and Qualified Legal Compliance Committee

• Past President of the National Bar Association and past President of the State Bar of Michigan

| | • Active in public service and with civic and charitable organizations, serving in leadership positions with the Detroit Public Safety Foundation, the Detroit Institute of Arts, and the Community Foundation for Southeast Michigan

• Past chair of the United Way for Southeastern Michigan; Mr. Turner continues to serve on its executive committee

| | |

| | | MASCO 2016 | | PART I – CORPORATE GOVERNANCE |

CLASSClass II DIRECTORS

(TermDirectors (Term Expiring at the Annual Meeting in 2017)2020)

| | | 6 | | | | Board of Directors | | | 8 | | | | Leadership Structure of our Board of Directors | | | 8 | | | | Director Independence | | | 9 | | | | Board Refreshment | | | 9 | | | | Board Membership and Composition | | | 10 | | | | Risk Oversight | | | 11 | | | | Board Meetings and Attendance | | | 11 | | | | Communications with our Board of Directors | | | 11 | | | | Committees of our Board of Directors | | | 12 | | | | Director Compensation Program | | | 15 | | | | Related Person Transactions | | | 17 | | | | Proposal 1: Election of Class III Directors | | | 19 | | | | PART II - COMPENSATION DISCUSSION AND ANALYSIS | | | | | | | Compensation Discussion and Analysis Summary | | | 20 | | | | Compensation Decisions in 2017 | | | 24 | | | | Our 2017 Financial Performance | | | 24 | | | | How We Performed Against our Performance Compensation Goals | | | 24 | | | | Our 2017 Annual Performance Program | | | 24 | | | | Our Long Term Incentive Program | | | 26 | | | | Stock Options Granted in 2017 | | | 29 | | | | Other Components of our Executive Compensation Program | | | 29 | | | | Our Executive Compensation Program Highlights | | | 31 | | | | We Provide Long-Term Equity Incentives | | | 31 | | | | We Have a Long-Term Performance Program | | | 31 | | | | We Can Clawback Incentive Compensation | | | 31 | | | | We Require Minimum Levels of Stock Ownership by our Executives | | | 31 | | | | We Adopted Double-Trigger Change of Control Provisions for our Equity Awards | | | 32 | | | | Our Compensation Committee Conducts an Annual Compensation Risk Evaluation | | | 32 | | | | The Structure of our Compensation Programs Encourages Executive Retention and Protects Us | | | 32 | | | | We Prohibit Excise TaxGross-Up Payments | | | 33 | | | | We Prohibit Hedging and Pledging | | | 33 | | | | We Do Not Have Contractual Termination Agreements | | | 33 | | | | Our Annual Compensation Review Process | | | 33 | | | | Annual Management Talent Review and Development Process | | | 33 | | | | Compensation Data Considered by our Compensation Committee | | | 34 | |

TABLE OF CONTENTS | MASCO 2018

PART I - CORPORATE GOVERNANCE | MASCO 2018 | | | | |  | | Corporate Governance |

This section of our proxy statement provides information on the qualifications and experience of our director nominees and incumbent directors, the structure of our Board and our Board committees, and other important corporate governance matters. DIRECTOR AND DIRECTOR NOMINEES Our Board is divided into three classes. Following the election of the Class III directors nominated at this Annual Meeting, the terms of office of our Class I, Class II and Class III directors will expire at the Annual Meeting of Stockholders in 2019, 2020 and 2021, respectively, or when their respective successors are elected and qualified. In addition to meeting the criteria that are described below under “Board Membership and Composition,” each of our director nominees and each continuing director brings a strong and unique background and set of skills to our Board. As a result, our Board as a whole possesses competence and experience in a wide variety of areas. | | | | | | | | | | | | | | | | | | Skills and Expertise Represented by our Directors and Director Nominees | | | | | | | | | | | | | | |  | | Keith J. Allman

| | | | | | Age: 53 | Director since 2014

RELEVANT SKILLS AND EXPERIENCE

Mr. Allman brings to our Board strong business leadership skills, hands-on operational experience with our businesses and valuable insight into our culture. He played an integral role in developing our strategies to strengthen our brands and improve our execution, which has helped to provide the foundation for the current direction of our Company. His key leadership positions within our Company have given him deep knowledge of all aspects of our business, and he also possesses a significant understanding of, and experience with, complex operations as well as company-specific customer expertise.

BUSINESS EXPERIENCE

| | | | | | • Masco Corporation:

• Group President (2011-2014)

• President, Delta Faucet (2007-2011)

• Executive Vice President, Builder Cabinet Group (2004-2007)

• Served in various management positions of increasing responsibility at Merillat Industries (1998-2003)

| | • Director of Oshkosh Corporation

| | |

| | | | | Executive management | | | | Finance and accounting | | | | Growth strategy | | | | Risk management | | | | Marketing and brand management | | | | | | | | | | | | | | |  | | J. Michael Losh

| | | | | | Age: 69 | Director since 2003

RELEVANT SKILLS AND EXPERIENCE

Mr. Losh has strong leadership skills gained through significant executive leadership positions and through his service on boards of other publicly held companies in various industries. His current activities provide him with valuable exposure to developments in board oversight responsibilities, corporate governance, risk management, accounting and financial reporting, which enhances his service to us as Chairman of our Board. In addition, Mr. Losh has experience with and understands complex international financial transactions. He possesses substantial finance and accounting expertise gained through his experience as CFO of large organizations and through his service on other boards and audit committees.

BUSINESS EXPERIENCE

| | | | | | • Director of Prologis, Aon plc, and H.B. Fuller Company

• During the past five years, Mr. Losh served as a director of CareFusion Corporation and TRW Automotive Holdings Corp.

| | • Interim Chief Financial Officer of Cardinal Health, Inc. (2004-2005)

• Served for 36 years in various capacities at General Motors Corporation until his retirement in 2000

| | |

| | | | | Global operations | | | | Corporate governance and board oversight | | | | Talent management | | | | Portfolio strategy | | | | | | | | | | | | | | | | | | Business development and M&A | | | | Innovation | | | | Legal and compliance | | | | Government relations | | | | Executive compensation | |

MASCO 2018 | PART I - CORPORATE GOVERNANCE DIRECTOR NOMINEES FOR CLASS III (Term Expiring at the Annual Meeting in 2021) | | |

| | | Mark R. Alexander | AGE: 53 | DIRECTOR SINCE: 2014 | POSITION: • Senior Vice President of Campbell Soup Company, a manufacturer and marketer of branded convenience products, since 2010 (through April 2, 2018) • President of Americas Simple Meals and Beverages, Campbell Soup Company, since 2015 (through April 2, 2018) | RELEVANT SKILLS AND EXPERIENCE: As President of Campbell Soup Company’s largest division, Mr. Alexander brings to our Board strong leadership skills and experience in developing and executing business growth strategies. His current business responsibilities include investing in brand-building, innovation and expanded distribution, which correspond to areas of focus at our business operations. His extensive international experience with consumer branded products and his background in marketing and customer relations also provide our Board with expertise and insight as we leverage our consumer brands in the global market. | PART I – CORPORATE GOVERNANCE | | MASCO 2016 |

| | | | | | | | BUSINESS EXPERIENCE: • Campbell Soup Company: • President of Campbell North America (2012-2015), Campbell International (2010-2012) and Asia Pacific(2006-2009) • Chief Customer Officer and President – North America Baking & Snacking (2009-2010) • Served in various marketing, sales and management roles in the United States, Canada, Europe and Asia since 1989 • Member of the Board of Governors of GS1 U.S., anot-for-profit information standards organization | | |  | | Christopher A. O’Herlihy

|

| | |

| | | Richard A. Manoogian | AGE:81 | DIRECTOR SINCE: 1964 | POSITION: Chairman Emeritus, since 2012 | RELEVANT SKILLS AND EXPERIENCE: Mr. Manoogian was instrumental in the dramatic growth of Masco to become a global leader in the design, manufacture and distribution of branded home improvement and building products. His experience in navigating our Company through various phases of its transformation and diversification provides our Board with unique and extensive knowledge of our Company’s history and strategies. As a long-term leader at Masco, Mr. Manoogian possesses firsthand knowledge of our operations as well as a deep understanding of the residential repair and remodeling and new home construction industries. | BUSINESS EXPERIENCE: • Our Chairman of the Board (1985-2012) • Masco Corporation: • Executive Chairman (2007-2009) • Chief Executive Officer (1985-2007) • Elected President in 1968 and Vice President in 1964 • Director of Ford Motor Company (2001-2014) | | | | Age: 52 | Director since 2013

RELEVANT SKILLS AND EXPERIENCE

Mr. O’Herlihy joined Illinois Tool Works Inc. in 1989 and has been promoted to various positions with increased responsibilities. In his various roles, he has acquired extensive knowledge and experience in all aspects of business, including business strategy, operations, acquisitions, emerging markets, financial performance and structure, legal matters, and human resources/talent management. His current responsibilities include developing and executing the overall corporate growth strategy. He brings to our Board strategic insight and understanding of complex business and manufacturing operations, as well as a valuable perspective of international business operations, gained through his experience with a multi-billion dollar diversified global organization.

BUSINESS EXPERIENCE

|

PART I - CORPORATE GOVERNANCE | MASCO 2018 | | |

| | | John C. Plant | AGE: 64 | DIRECTOR SINCE: 2012 | POSITION: Retired Chairman of the Board and Chief Executive Officer of TRW Automotive Holdings Corp., a diversified automotive supplier | RELEVANT SKILLS AND EXPERIENCE: Based on his leadership positions with multi-billion dollar diversified global companies, Mr. Plant brings to our Board strategic insight and understanding of complex operations as well as a valuable perspective of international business. He understands how to manage a company through economic cycles and major transactions. He also has a strong background in finance and extensive knowledge and experience in all aspects of business, including operations, business development matters, financial performance and structure, legal matters and human resources. | BUSINESS EXPERIENCE: • Chairman of the Board of Arconic Inc. (formerly Alcoa Inc.); Director of Jabil Circuit, Inc. and Gates Corporation • TRW Automotive Holdings Corp.: • Chairman of the Board (2011-2015) • President and Chief Executive Officer and Director (2003-2015) • Co-member of the Chief Executive Office of TRW Inc. and the President and Chief Executive Officer of the automotive business of TRW Inc. (2001-2003) • Director of the Automotive Safety Council | | | | • Illinois Tool Works Inc.:

• Executive Vice President, with worldwide responsibility for Illinois Tool Works’ Food Equipment Group (2010-2015)

• Group President – Food Equipment Group Worldwide (2010)

• Group President – Food Equipment Group International (2009-2010)

• For approximately 26

|

MASCO 2018 | PART I - CORPORATE GOVERNANCE CLASS I DIRECTORS (Term Expiring at the Annual Meeting in 2019) | | |

| | | Marie A. Ffolkes | AGE: 46 | DIRECTOR SINCE: 2017 | POSITION: • President, Industrial Gases, Americas of Air Products & Chemicals, Inc., since 2015 | RELEVANT SKILLS AND EXPERIENCE: As President, Industrial Gases, Americas of Air Products & Chemicals, Inc., Ms. Ffolkes is responsible for leading the strategy implementation and profitability of the company’s industrial gases operations in North America and South America. Ms. Ffolkes has strong leadership skills in areas important to Masco’s performance including, operations, finance, international markets, marketing and personnel. | BUSINESS EXPERIENCE: • Tenneco: • Global Vice President and General Manager, Ride Performance Group (2013-2015) • Vice President and General Manager, Global Elastomers(2011-2013) • Johnson Controls International plc (formerly, Johnson Controls): • Vice President & General Manager South America Region, Automotive Group (2010 – 2011) • Vice President and General Manager,Hyundai-Kia Customer Business Unit (2008 – 2010) • Global Vice President, Japan (2006 - 2008) |

| | |

| | | Donald R. Parfet | AGE:65 | DIRECTOR SINCE: 2012 | POSITION: • Managing Director, Apjohn Group, LLC, a business development company, since 2000 • General Partner, Apjohn Ventures Fund, Limited Partnership, a venture capital fund, since 2003 | RELEVANT SKILLS AND EXPERIENCE: As an executive with responsibilities for numerous global businesses, Mr. Parfet brings extensive financial and operating experience to our Board, particularly in areas of financial and corporate staff management and senior operational practices for multiple global business units. His experience in business development and venture capital firms provides our Board with a valued perspective on growth and strategy. He is also experienced in leading strategic planning, risk assessment, human resource planning and financial planning and control. His global operating experience, strong financial background and proven leadership capabilities are especially important to our Board’s consideration of product and geographic expansion and business development opportunities. | BUSINESS EXPERIENCE: • Lead Director of Kelly Services, Inc. and Rockwell Automation, Inc., Chairman of the Board of Sierra Oncology, Inc. • Senior Vice President, Pharmacia Corporation, a pharmaceutical company, from which he retired in 2000 • Served as a senior corporate officer of Pharmacia & Upjohn and The Upjohn Company, predecessors of Pharmacia Corporation • Director and trustee of a number of charitable and civic organizations |

PART I - CORPORATE GOVERNANCE | MASCO 2018 | | |

| | | Lisa A. Payne | AGE: 59 | DIRECTOR SINCE:2006 | POSITION: Former Vice Chairman and Chief Financial Officer of Taubman Centers, Inc., a real estate investment trust | RELEVANT SKILLS AND EXPERIENCE: Ms. Payne provides leadership and executive management experience to our Board. She also possesses substantial financial, accounting and corporate finance expertise gained through her experience as Chief Financial Officer of Taubman Centers and as an investment banker. Her financial focus and proficiency helped guide Taubman Centers through the economic recession and increase shareholder value. She brings to our Board an understanding of growth strategy. In addition, Ms. Payne’s extensive experience in real estate investment, development and acquisition gives her an informed and thorough understanding of macroeconomic factors that may impact our business. | BUSINESS EXPERIENCE: • Director of J.C. Penney Company, Inc. and Rockwell Automation, Inc. • Chairman of the Board of Soave Enterprises, LLC, a privately held diversified management and investment company (2016 – 2017) • President of Soave Real Estate Group (2016 – 2017) • Taubman Centers, Inc.: • Vice Chairman (2005-2016) • Chief Financial Officer (2005-2015) • Executive Vice President and Chief Financial and Administrative Officer (1997-2005) • During the past five years, served as director of Taubman Centers, Inc. and Soave Enterprises, LLC • Investment banker, Goldman, Sachs & Co. (1987-1997) |

| | |

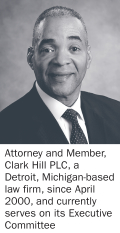

| | | Reginald M. Turner | AGE: 58 | DIRECTOR SINCE: 2015 | POSITION: Attorney and Member, Clark Hill PLC, a Detroit, Michigan-based law firm, since April 2000, and currently serves on its Executive Committee | RELEVANT SKILLS AND EXPERIENCE: As an accomplished litigator and legal advisor with expertise in labor and employment law and government relations, Mr. Turner brings to our Board substantial insight in these areas. His background, coupled with his service as a director of a financial institution and a member of its enterprise risk committee, make him a valuable asset to our Board in the areas of risk management and finance. Mr. Turner has numerous and varied experiences in business, civic and charitable leadership roles, and his skills and insight benefit our Board as it considers issues of risk management, corporate governance and legal risk. | BUSINESS EXPERIENCE: • Director of Comerica Incorporated since 2005, where he currently chairs that board’s Enterprise Risk Committee and serves on its Audit Committee • Past President of the National Bar Association and past President of the State Bar of Michigan • Active in public service and with civic and charitable organizations, serving in leadership positions with the Detroit Public Safety Foundation, the Detroit Institute of Arts, and the Community Foundation for Southeast Michigan • Past chair of the United Way for Southeastern Michigan; Mr. Turner continues to serve on its executive committee |

MASCO 2018 | PART I - CORPORATE GOVERNANCE DIRECTOR NOMINEES FOR CLASS II (Term Expiring at the Annual Meeting in 2020) | | |

| | | Keith J. Allman | AGE: 55 | DIRECTOR SINCE: 2014 | POSITION: Our President and Chief Executive Officer, since 2014 | RELEVANT SKILLS AND EXPERIENCE: Mr. Allman brings to our Board strong business leadership skills,hands-on operational experience with our businesses and valuable insight into our culture. He played an integral role in developing our strategies to strengthen our brands and improve our execution, which has helped to provide the foundation for the current direction of our Company. His key leadership positions within our Company have given him deep knowledge of all aspects of our business, and he also possesses a significant understanding of, and experience with, complex operations as well as company-specific customer expertise. | BUSINESS EXPERIENCE: • Masco Corporation: • Group President (2011-2014) • President, Delta Faucet (2007-2011) • Executive Vice President, Builder Cabinet Group (2004-2007) • Served in various management positions of increasing responsibility at Merillat Industries (1998-2003) • Director of Oshkosh Corporation |

| | |

| | | J. Michael Losh | AGE:71 | DIRECTOR SINCE:2003 | POSITION: Retired Chief Financial Officer and Executive Vice President of General Motors Corporation, a global automotive company | RELEVANT SKILLS AND EXPERIENCE: Mr. Losh has strong leadership skills gained through significant executive leadership positions and through his service on boards of other publicly held companies in various industries. His current activities provide him with valuable exposure to developments in board oversight responsibilities, corporate governance, risk management, accounting and financial reporting, which enhances his service to us as Chairman of our Board. In addition, Mr. Losh has experience with and understands complex international financial transactions. He possesses substantial finance and accounting expertise gained through his experience as Chief Financial Officer of large organizations and through his service on other boards and audit committees. | BUSINESS EXPERIENCE: • Director of Prologis, Aon plc, and H.B. Fuller Company • During the past five years, served as a director of CareFusion Corporation and TRW Automotive Holdings Corp. • Interim Chief Financial Officer of Cardinal Health, Inc. (2004-2005) • Served for 36 years in various capacities at General Motors Corporation until his retirement in 2000 |

PART I - CORPORATE GOVERNANCE | MASCO 2018 | | |

| | | Christopher A. O’Herlihy | AGE: 54 | DIRECTOR SINCE:2013 | POSITION: Vice Chairman of Illinois Tool Works Inc., a global diversified industrial manufacturer of specialized industrial equipment, consumables, and related service businesses, since 2015 | RELEVANT SKILLS AND EXPERIENCE: Mr. O’Herlihy joined Illinois Tool Works Inc. in 1989. During his almost 30 years with Illinois Tool Works, he has held several executive positions through which he has acquired extensive knowledge and experience in all aspects of business, including business strategy, operations, acquisitions, emerging markets, financial performance and structure, legal matters and human resources/talent management. His current responsibilities include developing and executing the overall corporate growth strategy. He brings to our Board strategic insight and understanding of complex business and manufacturing operations, as well as a valuable perspective of international business operations, gained through his experience with a multi-billion dollar diversified global organization. | BUSINESS EXPERIENCE: • Illinois Tool Works Inc.: • Executive Vice President, with worldwide responsibility for Illinois Tool Works’ Food Equipment Group (2010-2015) • Group President – Food Equipment Group Worldwide (2010) • Group President – Food Equipment Group International(2009-2010) • For almost 30 years, served in various positions of increasing responsibility, including as Group President of the Polymers and Fluids Group |

| | |

| | | Charles K. Stevens, III | AGE: 58 | DIRECTOR SINCE: 2018 | POSITION: Executive Vice President and Chief Financial Officer of General Motors Company since 2014 �� | RELEVANT SKILLS AND EXPERIENCE: Mr. Stevens joined General Motors Company in 1983 with the Buick Motor Division. He brings over 30 years of financial experience to our board. His extensive background and expertise will provide our management and board with a significant understanding of finance, financial operations, international financial matters and consumer goods. His current responsibilities include leading General Motor Company’s global financial and accounting operations. | BUSINESS EXPERIENCE: • General Motors Company: • Chief Financial Officer of GM North America (2010-2014). • Interim Chief Financial Officer of GM South America (2011-2013) • Chief Financial Officer of GM de Mexico (2008-2010) • Chief Financial Officer of GM Canada (2006-2008) • For more than 30 years, served in various positions of increasing responsibility, including several leadership positions with GM’s Asia Pacific region including China, Singapore, Indonesia and Thailand • Member of the University of Michigan Stephen M. Ross School of Business Advisory Board. |

MASCO 2018 | PART I - CORPORATE GOVERNANCE BOARD OF DIRECTORS Our Board of Directors is committed to maintaining our high standards of ethical business conduct and corporate governance principles and practices. | | Key Facts about our Board | | • Chairman of the Board: J. Michael Losh | | • Our current Chairman and CEO roles are separate | | • 7 Board meetings were held in 2017 | | • Over 80% of our continuing directors are independent | | • Each member of our Audit Committee, Compensation Committee and Governance Committee is independent | | • Over 70% of our continuing directors have joined our Board in the last 7 years | | • 2 of our 11 continuing directors are female | | • The average age of our continuing independent directors is 59 |

Leadership Structure of our Board of Directors Mr. J. Michael Losh was appointed as Chairman of our Board on May 4, 2015. At that time, Mr. Losh also became the Chair of our Corporate Governance and Nominating Committee. Mr. Losh has served on our Board since 2003, including as the Chair of our Audit Committee from 2008-2015. Effective Oversight of our Company As an independent Chairman of our Board, Mr. Losh has a strong working relationship with the other directors and with our management. His responsibilities include: presiding at Board meetings and at executive sessions of the independent directors; providing advice to our CEO; consulting with management regarding information sent to our Board; approving our Board’s meeting agendas and assuring that there is sufficient time for discussion of all agenda items; overseeing the Board’s annual review of our strategic plan and its execution; calling meetings of the independent directors, as necessary; and overseeing our Board and Committee self-evaluation process. Separation of our Chairman of the Board and CEO Roles Our Board believes that its leadership structure is in the best interests of the Company and our stockholders at this time; however, our Board has no policy with respect to the separation of the roles of CEO and Chairman and believes that this matter should be discussed and determined by the Board from time to time, based on all of the then-current facts and circumstances. If the roles of Chairman and CEO are combined in the future, the role of Lead Director could become part of our Board leadership structure. Communications with our Chairman of the Board If you are interested in contacting the Chairman of our Board, you may send your communication in care of our Secretary to the address specified in “Communications with Our Board of Directors” below. PART I - CORPORATE GOVERNANCE | MASCO 2018 Director Independence Our Corporate Governance Guidelines require that a majority of our directors qualify as “independent” under the requirements of applicable law and the New York Stock Exchange’s listing standards. Director Independence Standards For a director to be considered independent, our Board must determine that the director does not have any direct or indirect material relationship with us. Our Board has adopted standards to assist it in making a determination of independence for directors. These standards are posted on our website at www.masco.com. Assessment of our Directors’ Independence Our Board has determined that nine of our eleven continuing directors, including all of ournon-employee directors other than Mr. Manoogian, are independent. As an employee, Mr. Allman, our President and Chief Executive Officer, is not an independent director. Our independent directors are Messrs. Alexander, Losh, O’Herlihy, Parfet, Plant, Stevens and Turner, Ms. Ffolkes and Ms. Payne. In making its independence determinations, our Board reviewed all transactions, relationships and arrangements for the last three fiscal years involving eachnon-employee director and the Company. In evaluating Mr. O’Herlihy’s independence, our Board considered our purchases of goods from Illinois Tool Works Inc. and its subsidiaries. The aggregate amount of these purchases was approximately $0.6 million in 2017. Illinois Tool Works has reported revenue of $14.3 billion in 2017. Our Board does not believe that Mr. O’Herlihy has a material interest in these transactions. In evaluating Ms. Ffolkes’s independence, our Board considered our purchases of goods from Air Products and Chemicals, Inc. and its subsidiaries. The aggregate amount of these purchases was approximately $0.5 million in 2017. Air Products and Chemicals has reported revenue of $8.2 billion for its fiscal year ended September 30, 2017. Our Board does not believe that Ms. Ffolkes has a material interest in these transactions. In evaluating Mr. Stevens’ independence, our Board considered an agreement that we had with General Motors Company that provided for a credit from General Motors Company on certain vehicles that we leased through third parties. Our credits for 2017 were approximately $2,500. General Motors Company has reported revenue of $145.6 billion in 2017. Our Board does not believe that Mr. Stevens has a material interest in this arrangement. Our Board also determined that we did not make any discretionary charitable contributions exceeding the greater of $1 million or 2% of the revenues of any charitable organization in which any of our directors was actively involved in theday-to-day operations. Committee Member Independence Assessment Our Board has determined that each member of our Audit Committee, Compensation Committee and Governance Committee qualifies as independent. Board Refreshment Our Governance Committee reviews current director tenure, including whether any vacancies are expected on our Board due to retirement or otherwise, and periodically assesses the composition of our Board by reviewing director skills and expertise currently represented. Our Board’s completion of director skills matrices has provided our Governance Committee insight into our Board composition. The Committee used this information to evaluate the skills and experience represented on our Board and to identify anticipated skills and experience that would be valuable in the future to best support the Company’s strategic objectives. In 2017 our Governance Committee and Board focused on director candidate recruitment, which resulted in the appointment of two new independent directors, Ms. Marie Ffolkes and Mr. Charles Stevens. MASCO 2018 | PART I - CORPORATE GOVERNANCE Director Refreshment Seven new independent directors have joined our Board since 2012, bringing fresh and diverse perspectives. These directors have particular strength in the areas of executive management, finance and accounting, global operations, business and growth strategy, brand management, risk management, talent management and government relations. We believe the addition of these new directors, combined with our directors who have experience with us, provides a desirable balance of deep, historical understanding of our Company and new perspectives, resulting in strong guidance and oversight to our executive management team. Chairman and Committee Refreshment In May 2015, our Board appointed Mr. Losh as our new independent Board Chairman. Mr. Losh has been a member of our Board since 2003, and served as our Audit Committee Chair from 2008 to 2015, stepping down from that position when he was appointed as Chair of our Governance Committee. Additionally, on an annual basis our Governance Committee evaluates committee chair and member assignments and changes are made periodically. In May 2015, new Chairs were appointed to our Audit and Compensation Committees. Board Membership and Composition Board Membership Our Governance Committee believes that directors should possess exemplary personal and professional reputations, reflecting high ethical standards and values. The expertise and experience of directors should provide a source of strategic oversight, advice and guidance to our management. A director’s judgment should demonstrate an inquisitive and independent perspective with acute intelligence and practical wisdom. Directors should be free of any significant business relationships which would result in a potential conflict in judgment between our interests and the interests of those with whom we do business. Each director should be committed to serving on our Board for an extended period of time and to devoting sufficient time to carry out the director’s duties and responsibilities in an effective manner for the benefit of our stockholders. Our Governance Committee also considers additional criteria adopted by our Board for director nominees and the independence, financial literacy and financial expertise standards required by applicable law and by the New York Stock Exchange. Board Composition Neither our Board nor our Governance Committee has adopted a formal Board diversity policy. However, as part of its assessment of Board composition and evaluation of potential director candidates, our Governance Committee considers whether our directors hold diverse viewpoints, professional experiences, education and other skills and attributes that are necessary to enhance Board effectiveness. In addition, our Governance Committee believes that it is desirable for Board members to possess diverse characteristics of race, national and regional origin, ethnicity, gender and age, and considers such factors in its evaluation of candidates for Board membership. Director Candidate Recommendations The Governance Committee uses a number of sources to identify and evaluate director nominees. It is the Governance Committee’s policy to consider director candidates recommended by stockholders. All Board candidates, including those recommended by stockholders, are evaluated against the criteria described above. Stockholders wishing to have the Governance Committee consider a candidate should submit the candidate’s name and pertinent background information to our Secretary at the address stated below in “Communications with our Board of Directors.” Stockholders who wish to nominate director candidates for election to our Board should follow the procedures set forth in our Certificate of Incorporation and Bylaws. For a summary of these procedures, see “2019 Annual Meeting of Stockholders” below. PART I - CORPORATE GOVERNANCE | MASCO 2018 Risk Oversight Our Board oversees our risk management practices, both directly and through its Committees. Our Board exercises its risk oversight through an annual review and discussion of a comprehensive analysis prepared by management on material risks facing us and related mitigating activities; updates regarding these risks are presented at subsequent Board meetings. Our President and Chief Executive Officer, as the head of our management team and a member of our Board, assists our Board in its risk oversight function and leads those discussions. | | | | | | | | Key Risk Oversight Responsibilities of our Board of Directors | | | | | Strategic | | Operational | | Financial | | Legal, regulatory and compliance |

| | | | | | | | Key Risk Oversight Responsibilities of our Audit Committee | | | | Key Risk Oversight Responsibilities of our Compensation Committee | • Financial reporting • Internal controls over financial reporting • Legal and regulatory compliance • Code of Business Ethics | | | | • Executive compensation programs and policies • CEO and executive management succession planning |

Board Meetings and Attendance Board Meetings Our Board held seven meetings in 2017, one of which focused primarily on reviewing our long-term strategic plan with management. In addition to the Board meetings at our corporate headquarters, in 2017 our directors visited one of our manufacturing facilities to observe operations and meet with the facility’s management team. Meeting Attendance Each director attended at least 75% of our Board meetings and applicable committee meetings that were held in 2017 while such person served as a director. It is our policy to encourage directors to attend our Annual Meeting of Stockholders, and all of our directors attended our 2017 Annual Meeting except Ms. Ffolkes and Mr. Stevens, who joined our Board after the 2017 Annual Meeting, and Mr. Plant. Executive Sessions Ournon-employee directors frequently meet in executive session without management, and the independent directors meet separately at least once per year. Mr. Losh, as our Chairman of the Board, presides over these executive sessions. Communications with our Board of Directors If you are interested in contacting our Chairman of our Board, an individual director, our Board as a group, our independent directors as a group, or a specific Board committee, you may send a communication, specifying the individual or group you wish to contact, in care of: Kenneth G. Cole, Secretary, Masco Corporation, 17450 College Parkway, Livonia, Michigan 48152. MASCO 2018 | PART I - CORPORATE GOVERNANCE COMMITTEES OF OUR BOARD OF DIRECTORS The standing committees of our Board are the Audit Committee, the Compensation Committee and the Governance Committee. These committees function pursuant to written charters adopted by our Board. The committee charters, as well as our Corporate Governance Guidelines and our Code of Business Ethics, are posted on our website at www.masco.com and are available to you in print from our website or upon request. | | | | | | | | | | | | | | | | Audit Committee |  |

| | | | | | | | | | | | | | | | | | | | | | | Lisa A. Payne Chair | | Mark R. Alexander | | Marie A. Ffolkes | | Christopher A. O’Herlihy | | Donald R. Parfet | | John C. Plant | | Charles K. Stevens | | Reginald M. Turner |

| 5 meetings in 2017 | | All members are independent and financially literate | | Ms. Payne and Ms. Ffolkes and Messrs. Alexander, O’Herlihy, Parfet, Plant and Stevens qualify as “audit committee financial experts” as defined in Item 407(d)(5)(ii) of RegulationS-K | |

Audit Committee activities in 2017 included: reviewed and approved our 2016 Form10-K; reviewed our Form10-Qs filed in 2017; reviewed and approved our independent auditor’s 2017 integrated audit plan and service fees; discussed with management quarterly updates on our internal controls over financial reporting; reviewed the performance of our internal and independent auditors; reviewed with management quarterly updates on ethics hotline matters; discussed with management certain key risk management matters; reviewed impact of adoption of new accounting standards; and reviewed and approved our 2018 internal audit annual operating plan. Audit Committee responsibilities include assisting the Board in its oversight of: the integrity of our financial statements; the effectiveness of our internal controls over financial reporting; the qualifications, independence and performance of our independent auditors; the performance of our internal audit function; and the compliance with legal and regulatory requirements, including our employees’ compliance with our Code of Business Ethics. In addition, our Audit Committee reviews and discusses with management certain financial andnon-financial risks. PART I - CORPORATE GOVERNANCE | MASCO 2018 | | | | | | | | | | | | | | Organization and Compensation Committee |  | | | | | | |

| | | | | | MASCO 2016 | | PART I – CORPORATE GOVERNANCE |

CLASS III DIRECTORS

(Term Expiring at the Annual Meeting in 2018)

| | | | | | | | | | | | | | | | | Donald R. Parfet

Chair | | J. Michael Losh | | Christopher A.

O’Herlihy | | Lisa A. Payne | | Mary Ann

Van Lokeren | | | |  | | Mark R. Alexander

| | | | | | |

Age: 51 | Director since 2014

| 6 meetings in 2017 | | All members are independent | |

Compensation Committee activities in 2017 included: reviewed and approved the 2016 incentive compensation paid to our executive officers; reviewed the alignment of our business strategy with the current incentive compensation structure for our executive officers; established the 2017 performance metrics and goals for our 2017 Annual Incentive Program and 2017-2019 Long Term Incentive Plan; evaluated CEO and executive management succession planning; reviewed our CEO pay ratio determination process; reviewed the independence of compensation consultant; reviewed with management reports on our 2017 shareholder engagement activities; discussed with management an organization and talent update and talent strategy; and assessed the risk of our compensation programs and policies. Our Compensation Committee is responsible for: determining the compensation paid to our executive officers; evaluating the performance of our senior executives; determining and administering restricted stock awards and options granted under our stock incentive plan; administering our annual and long-term performance compensation programs; and reviewing our management succession plan, including periodically reviewing our CEO’s evaluation and recommendation of potential successors. In addition, our Compensation Committee evaluates risks arising from our compensation policies and practices, and has determined that such risks are not reasonably likely to have a material adverse effect on us. Our executive officers and other members of management report to the Compensation Committee on executive compensation programs at our business units to assess whether these programs or practices expose us to excessive risk. MASCO 2018 | PART I - CORPORATE GOVERNANCE RELEVANT SKILLS AND EXPERIENCE | | | | | | | | | | | | | | Corporate Governance and Nominating Committee As President of Campbell Soup Company’s largest division, Mr. Alexander brings to our Board strong leadership skills and experience in developing and executing business growth strategies. His current business responsibilities include investing in brand-building, innovation and expanded distribution, which correspond to areas of focus at our business operations. His extensive international experience with consumer branded products and his background in marketing and customer relations also provide our Board with expertise and insight as we leverage our consumer brands in the global market.

BUSINESS EXPERIENCE

| | | | | | • Campbell Soup Company:

• President of Campbell North America (2012-2015), Campbell International (2010-2012) and Asia Pacific(2006-2009)

• Chief Customer Officer and President – North America Baking & Snacking(2009-2010)

• Served in various marketing, sales and management roles in the United States, Canada and abroad since 1989

| | • Chairman of the Board of Governors of GS1 U.S., a not-for-profit industry organization

|  | | |

| | | | | | | | | | | | | | | | | | | | | | | J. Michael Losh

Chair | | | | | | | | | | |  | | Richard A. Manoogian

| | Mark R.

Alexander | | Marie A. Ffolkes | | John C. Plant | | Charles K. Stevens | | Reginald M. Turner | | | | | | Age: 79 | Director since 1964

RELEVANT SKILLS AND EXPERIENCE

Mr. Manoogian was instrumental in the dramatic growth of Masco to one of the largest manufacturers in North America of brand-name products for home improvement and new home construction. His experience in navigating our Company through various phases of its transformation and diversification provides our Board with unique and extensive knowledge of our Company’s history and strategies. As a long-term leader at Masco, Mr. Manoogian possesses firsthand knowledge of our operations as well as a deep understanding of the home improvement and new home construction industries.

BUSINESS EXPERIENCE

| | | | | | • Our Chairman of the Board (1985-2012)

| | • Masco Corporation:

• Executive Chairman (2007-2009)

• Chief Executive Officer (1985-2007)

• Elected as President in 1968, and as Vice President in 1964

| | |

| | | PART I – CORPORATE GOVERNANCE | | MASCO 2016 |

| | | | | | | | | | |  | | John C. Plant

| | | | | | Age: 62 | Director since 2012

RELEVANT SKILLS AND EXPERIENCE

Based on his leadership positions with multi-billion dollar diversified global companies, Mr. Plant brings to our Board strategic insight and understanding of complex operations as well as a valuable perspective of international business. He understands how to manage a company through economic cycles and major transactions. He also has a strong background in finance and extensive knowledge and experience in all aspects of business, including operations, business development matters, financial performance and structure, legal matters and human resources.

BUSINESS EXPERIENCE

| | | | | | | | | | | | • Director of Alcoa, Inc., Jabil Circuit, Inc. and Gates Corporation, a privately held corporation

• TRW Automotive Holdings Corp.:

• Chairman of the Board (2011-2015)

• President and Chief Executive Officer and Director (2003-2015)

| | • Co-member of the Chief Executive Office of TRW Inc. and the President and Chief Executive Officer of the automotive business of TRW Inc. (2001-2003)

• Vice Chairman of the Kennedy Center Corporate Fund Board

• Director of the Automotive Safety Council

| | |

| | | | | | | | | | |  | | Mary Ann Van Lokeren | | | | | | Age: 68 | Director since 1997

RELEVANT SKILLS AND EXPERIENCE